when will capital gains tax rate increase

The first and easiest way to lower your capital gains burden is to take advantage of the capital gains tax exemption. Just as a reminder you will be considered a tax resident in Spain if you stay in the country for more than 183 days per year 6 months.

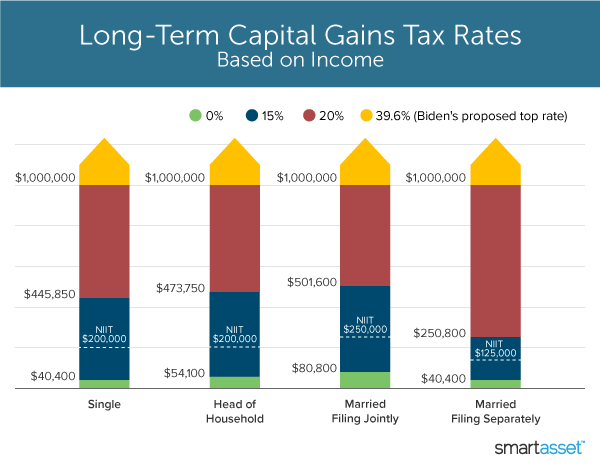

What S In Biden S Capital Gains Tax Plan Smartasset

Short-term capital gains tax rate.

. Capital gains tax CGT is the tax you pay on profits from selling assets such as property. You report capital gains and capital losses in your income tax return and pay tax on your capital gains. Capital Gains Tax Rate.

Capital Gains Tax for Spanish residents. That means that the tax wont apply to the first 250000 of your capital gains. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

Although it is referred to as capital gains tax it is. The other half of your capital gains also 82500 can be pocketed tax-free. The 0 long-term capital gains rate was created under the Jobs Growth and Tax Relief Reconciliation Act of 2003 also known as President Bushs second major piece of tax legislation with a delayed implementation of 2008.

Should you sell the investments at a higher price than you paid realized capital gain youll need to add 50 of the capital gain to your income. The Capital Gains Tax Exemption. The rule was scheduled to expire with the rest of the.

Mechanics Of The 0 Long-Term Capital Gains Tax Rate The 0 Rate Is Not Unlimited. The tax rate paid on most capital gains depends on the income tax bracketThose with taxable income of less than 80801 married. While the same rules apply to all gains and losses from real estate sales the rate at which gains are taxed is ultimately based on the income tax bracket you fall into.

For singles the current exemption is 250000. This is great news if your house hasnt appreciated more than. In that sense if you considered a resident the capital gains tax to be paid will.

Rates would be even higher in many US. All short-term capital gains are taxed at your regular income tax rateFrom a tax perspective it usually makes sense to hold onto investments for more than a year. Long-term capital gains tax rate.

In simple terms a capital gain is an increase in the value of an investment such as stocks or shares in. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. In Canada 50 of the value of any capital gains are taxable.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

What You Need To Know About Capital Gains Tax

What You Need To Know About Capital Gains Tax

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Pin By Investopedia Blog On Finance Terms Capital Gain What Is Capital Capital Gains Tax

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Much Is Capital Gains Tax It Depends On Holding Period And Income

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Yield Cgy Formula Calculation Example And Guide

What You Need To Know About Capital Gains Tax

Capital Gains Definition 2021 Tax Rates And Examples

Options Trading Taxes For All Traders Option Trading Futures Contract Capital Gains Tax

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)