how to pay late excise tax online

How do I pay my BBMP property tax online. Credit cards are only accepted as payment for current year individual income tax due on original Forms 500 500EZ 500ES corporate income tax due on original Forms 600 and 602ES and liabilities presented to taxpayers via Georgia Department of Revenue assessment notices.

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

To request a motor vehicle excise abatement please fill out an application or contact the Assessors Office at 508-324-2300.

. Once you do that the owners name of the property is displayed on the screen. The third party processing fee for e-checks is 160. Continued failure to pay will result in your license and registration being flagged for non-renewal at the Registry of Motor Vehicles.

Excise Tax is assessed at the rate of 2500 per thousand dollars of taxable value. If you select wrongly and you are better suited to file more often that as what you indicated on your GE Tax License application the Hawaii Department of Taxation will change your filing. An amended tax return is submitted to show corrections to the originally filed excise tax return.

To get your refund you have to file the return within three years of the due date. Interest and late payment penalties will apply to any amount not paid. Please click on Invoice Cloud Instructionsdoc for a quick guide on how to register and pay.

If you are paying a real estate personal property excise tax or watersewer bill the fee to use a creditdebit card is 275 of the transaction with a. From 2010 a new first year rate is to be introduced dubbed a showroom tax. Write your name and business name as it appears on your business registration.

To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET. Pay Property Tax Online Using Credit Card or E-Check. 25 62150You pay Minimum 695.

Delinquent Excise Tax and Parking Tickets City Clerks Office. How do I file my excise tax return electronically. Apply for a Payment Plan.

Up to 4045 2. This new tax was announced in the 2008 budget and the level of tax payable will be based on the vehicle excise duty band ranging from 0 for vehicles in the lower bands up to 950 for vehicles in the highest band. If so check the box located on page one of your return.

Return to Top. A payment plan can help you pay over time. 27 CFR 24271a The tax is submitted on TTB Form 500024 with a check or money order.

The Hawaii GE Tax instructions give you some guidance on what frequency you are supposed to select and that depends on how much in GE Tax you expect to pay. HR Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. Obamacare Tax Penalties.

25 47564You pay Minimum 695. If you were supposed to get a refund with the late return you could lose the refund depending on how late you file. All prices are subject.

To pay BBMP property tax online you need to follow the steps mentioned below. You can file and pay your returns electronically with Paygov TTBGov - Epayment. The address is shown on the back of the return.

BBMP Property Tax FAQs. Name and business Name. If you cant pay the full amount of your taxes or penalty on time pay what you can now and apply for a payment plan.

Majority of bills are due in late March or early AprilMotor Vehicle Excise Tax bills are issued each calendar year to each owner of a vehicle registered in Massachusetts. A minimum convenience fee of 415 for payments of 158 or lower otherwise a 299 convenience fee for payments over 158 will be charged and paid to a third party. Airport airway trust fund.

Write your account ID here. With insufficient health insurance coverage you might incur a tax penalty under Obamacare. If you are currently on registry hold for the non-payment of excise tax bills and you pay by e-check you must wait seven business days before we process your release with the registry.

Excise taxes dedicated to the Airport and Airway Trust Fund raised 90 billion in fiscal year 2020 down from 160 billion in fiscal year 2019. For convenient efficient and user-friendly way to pay bills online. VED can be automatically be collected from a.

You may reduce. 90 of the excise tax revenue comes. Tax bills Excise Tax Water Sewer Bills.

These fuel taxes raised 90 of the Highway Trust Fund 184 for gasoline and 244 for diesel fuel per gallon. This does not grant you an extension of time to pay. Learn more about amending your tax return.

The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others. Imposition of motor vehicle excise tax. Excise taxes on fuel raised 374 billion in fiscal year 2015.

Please select the department you wish to pay. Find out more on tax penalty how its calculated. An excise tax subject to the credit provided by Section 7-14-7l is imposed upon the sale in this state of every vehicle except as otherwise provided in Section 7-14-71 NMSA 1978 and manufactured homes required under the Motor Vehicle Code 66-1-1 NMSA 1978 to be registered in this state.

Birth Marriage Death Certificates Dog Licenses. If you need more time to prepare your tax return apply for an extension of time to file. 25 13427You pay Minimum 695.

Visit httpsbbmptaxkarnatakagovin Enter the Base application number. The value of a motor vehicle is determined by the Commissioner of Revenue based on. How is the tax paid.

New Gst Registration Procedure Gst Number Blog Tools Registration Confirmation Letter

Online Bill Payment Town Of Dartmouth Ma

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

How To File And Pay Sales Tax In Hawaii Taxvalet

50 Off Your Form 2290 Annual Renewal Fee Renew Form Filing

File Withholding Online Department Of Revenue Taxation

Treasurer And Tax Collector Belmontma

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

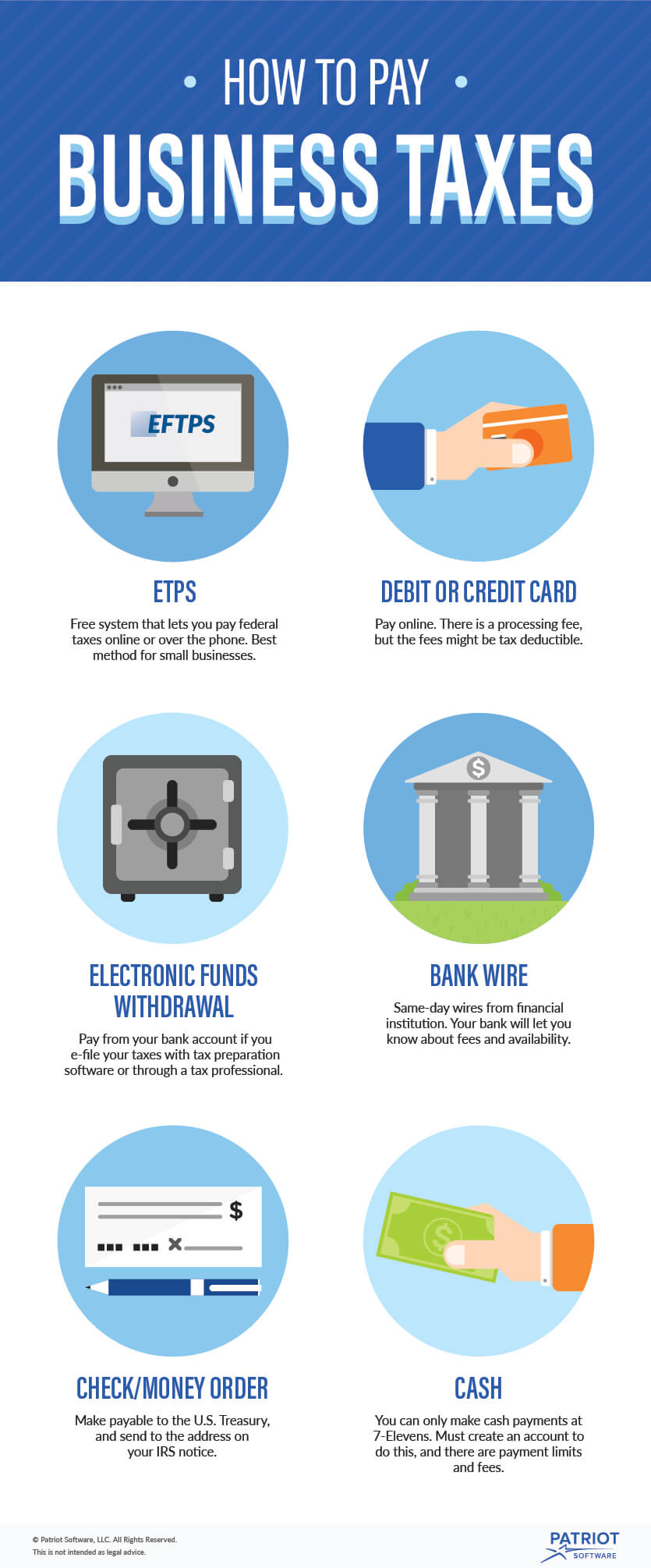

How To Pay Business Taxes Depositing Taxes With The Irs

Penalty For Late Filing Irs 1099 Information Return Irs Forms 1099 Tax Form Irs

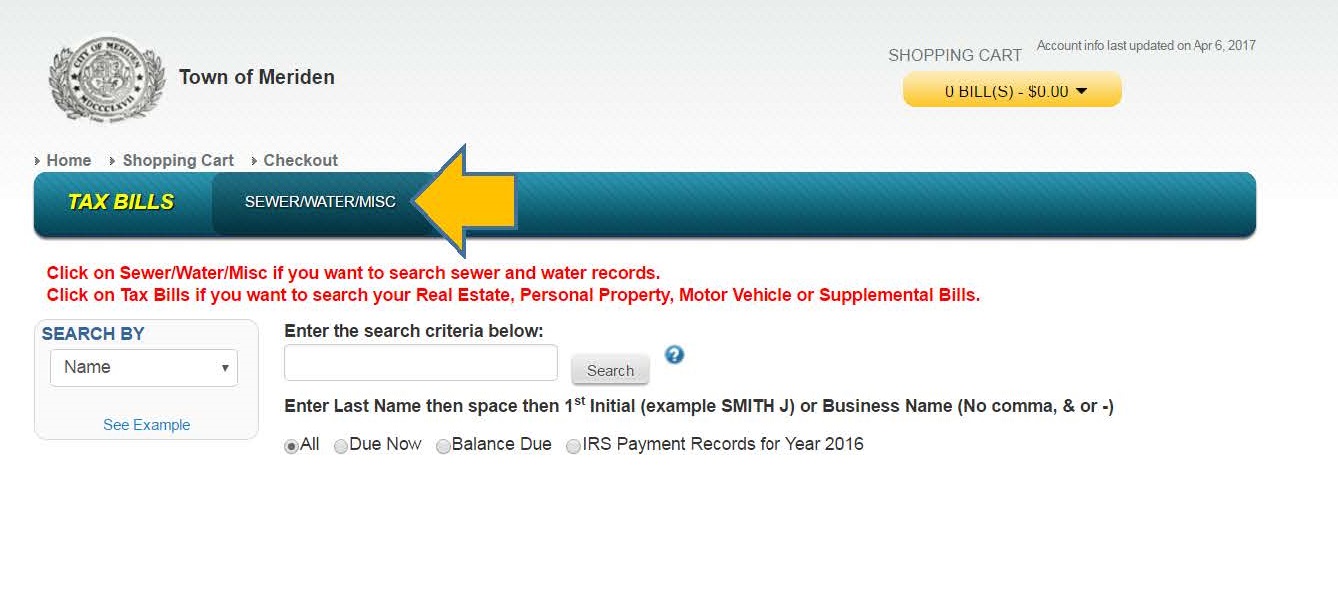

View Or Pay Your Taxes Utility Bill Online

Internet Sales Tax Definition Types And Examples Article

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Corporate Excise Tax Penalties Waived S Corporation Fiscal Year Corporate

How To Pay The Irs With Eftps Hourly Inc

Different Types Of Australian Taxes Types Of Taxes Tax Services Business Advisor

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City